EPAct State and Alternative Fuel Provider Fleet Newsletter: Fall 2014

The fall 2014 issue of the EPAct State and Alternative Fuel Provider Fleet Newsletter includes the following articles:

- Earn Credits for Electric Drive Vehicles, Infrastructure, Other Investments

- Updated Reporting Tool Reflects New Credit Allocations

- Calculate Biodiesel Use Correctly under Standard Compliance

- Alternative Compliance Tool Simplifies Reporting, Incorporates New Fuel Conversion Factors

- FAQ Page Gives You Answers to Common Questions

- Fleets Use the EPAct Website to Communicate Credit Availability

- Alternative Fuels Data Center Provides More Resources and Tools

- Common Fleet Questions Answered

Earn Credits for Electric Drive Vehicles, Infrastructure, Other Investments

The U.S. Department of Energy (DOE) issued a final rule on March 21, 2014, that establishes additional means by which the State and Alternative Fuel Provider Fleet Program covered fleets may earn credits under the Standard Compliance method. DOE promulgated the rule pursuant to Congress' direction, set forth in Section 133 of the Energy Independence and Security Act (EISA) of 2007. The table below summarizes the available credits for each new vehicle and technology type included in the rule. For more information, view the EISA Section 133 Electric Drive Vehicle and Infrastructure Final Rule fact sheet and the final rule itself. Note that only acquisitions and investments in newly eligible vehicles and technologies made during the model year 2014 and beyond will earn credits.

| Credit Category | Credit Allotment | Limitations and Notes |

|---|---|---|

| Hybrid electric vehicle (HEV) | ½ credit | |

| Plug-in hybrid electric vehicles (PHEV)* | ½ credit | PHEVs that can complete the U.S. Environmental Protection Agency (EPA) urban and highway test cycles on electricity alone were already considered an alternative fuel vehicle (AFV) and are allotted one full credit under the Standard Compliance method. |

| Fuel cell electric vehicle (FCEV) | ½ credit | |

| Neighborhood electric vehicles (NEVs) | ¼ credit | Acquisitions are not included in the covered light-duty vehicle (LDV) count to determine the fleet's AFV-acquisition requirement. |

| Medium- or heavy-duty HEV | ½ credit | Not included in covered LDV count. Credit is available only after the fleet has met its AFV-acquisition requirements. |

| Alternative fuel infrastructure | 1 credit per $25,000 invested* | Maximum of 5 credits per fleet per model year if private infrastructure, 10 credits if publicly accessible infrastructure. Credit allocated in model year infrastructure put into operation. |

| Alternative fuel non-road equipment | 1 credit per $25,000 invested* | Not included in covered LDV count. Maximum of 5 credits per fleet per model year. |

| Emerging technology | 2 credits for initial $50,000 invested and 1 credit per $25,000 thereafter, or 1 credit per pre-production vehicle* | Maximum of 5 credits if counting based on amount invested, per fleet per model year. |

|

* Fleets are allowed to aggregate dollar amounts between categories. Dollar amounts cannot include money received through grants or awards. |

||

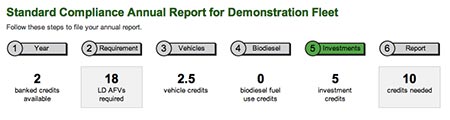

Updated Reporting Tool Reflects New Credit Allocations

The Standard Compliance Reporting Tool is up-to-date for model year 2014. Fleets may report acquisitions and investments in newly eligible vehicles and technologies for which AFV credit is now available under the EISA Section 133 rule. The tool integrates several calculations and checks to make sure that your data are correct.

Keep these tips in mind when entering your data:

- Enter all EVs, PHEVs, FCEVs, HEVs, and medium- and heavy-duty HEVs on tab (3) Vehicles. The information captured here is largely the same as in previous model year annual reports, except for a few new fields and changes to existing fields.

- Make sure to enter the Weight Class first so the appropriate defaults appear in other categories.

Vehicle Type is a new field. Use the Vehicle Decision Tree hyperlink to determine which selection is appropriate.

Vehicle Type is a new field. Use the Vehicle Decision Tree hyperlink to determine which selection is appropriate.- The tool will save your updates after each vehicle entry.

- Enter alternative fuel infrastructure, alternative fuel non-road equipment, and emerging technology investments on tab (5) Investments.

- Provide as much specific information as possible. This includes the Description field under Non-Road Equipment, as well as vendor details in the Purchased From fields.

- The In-Service Date must be within the applicable model year.

- Emerging technology investments may earn credit based on vehicle acquisitions or based on the overall investment, but not both.

- Dollar amounts entered in the Investments tab may not include any funding that your fleet received through a grant or other monetary award.

- Be sure to enter all investments, even if the total does not meet the minimum, to earn a credit in a certain category. The tool will automatically aggregate remaining investments to ensure your credits for investments are maximized.

- The tool will save your updates after each vehicle entry.

Reporting Tips:

- Existing fleet points of contact: When you log in to report your model year 2014 fleet data, don't forget to update your contact information. Do so by selecting "My Account" in the left navigation panel. You can also update individual fleet contact information by selecting "Manage Fleet Contact" under "Fleet Management."

- New fleet points of contact: Credentials are specific to each person. Please do not log in using the previous fleet point of contact's credentials. Instead, click "Get Started" on the Compliance Tool login page to create your own account. Once you have done so, contact us to have your account linked with your fleet.

Additional guidance is available by clicking on the blue question mark icon ("?") tooltips and hyperlinks within the reporting tool. For more information, refer to the June 4, 2014, webinar, Updated Annual Reporting Tool to Include Electric Drive Vehicles and Infrastructure and also to the relevant sections of the EPAct website's Frequently Asked Questions for State and Alternative Fuel Provider Fleets. If you are looking for assistance with reporting, contact us.

Calculate Biodiesel Use Correctly under Standard Compliance

Under the Standard Compliance method, fleets may earn biodiesel fuel use credits to help satisfy their AFV-acquisition requirements. When reporting biodiesel purchase and use, it is important to keep the following in mind:

- Only biodiesel used in blends of B20 (20% biodiesel, 80% petroleum diesel) or higher may be counted toward the requirement. Under the Standard Compliance method, fleets may not count use of B5, B10, or any blend below B20.

- Under the Standard Compliance method, biodiesel fuel use may only be used to satisfy up to a maximum of 50% of the AFV-acquisition requirement.

- Fleets receive one credit for each 450 gallons of B100 (100% or "neat" biodiesel), which equates to 2,250 gallons of B20. Rounding up is not allowed.

As an example, if a fleet used the following during model year 2014:

- 8,000 gallons of B50

- 6,000 gallons of B20

- 4,000 gallons of B10 – Does not get counted

The calculation would be as follows:

[8,000 gallons x (0.50)] + [6,000 gallons x (0.20)] = 5,200 gallons of B100* / 450 gallons = 11.56, or 11 credits

* In the Standard Compliance online reporting tool, 5,200 gallons should be entered as the total B100 used.

Note that if your fleet uses large amounts of low-level blends or more biodiesel than can be applied to your AFV-acquisition requirement, you should consider complying via the Alternative Compliance method in future model years.

Alternative Compliance Tool Simplifies Reporting, Incorporates New Fuel Conversion Factors

The Alternative Compliance method allows covered fleets to meet program requirements by reducing their petroleum consumption in lieu of acquiring AFVs. Fleets do this through a variety of petroleum reduction approaches, including alternative fuel use in AFVs. In an effort to facilitate compliance with the annual reporting requirement and streamline efforts by Alternative Compliance fleets, DOE is making available to fleets a simple Excel spreadsheet tool that allows easy entry of information needed to demonstrate compliance. A draft version of this spreadsheet will be emailed to Alternative Compliance fleets in coming weeks for their use, and DOE will welcome feedback on this version.

Regarding reporting of alternative fuel use, all activities are measured against the fleet's petroleum-use reduction requirement in gasoline gallon equivalents (GGE). Below is an updated list of common conversion factors that fleets should use to measure their alternative fuel use under Alternative Compliance. For a full list, visit the Fuel Conversion Factors to GGEs website. The spreadsheet tool incorporates these values and does the calculation for fleets.

| Fuel Type | Fuel Measurement Unit | Conversion Factor | GGE Calculation |

|---|---|---|---|

| B100* | Gallons | 1.066 | GGE = B100 gal x 1.066 |

| Compressed Natural Gas (CNG) | Hundred cubic feet | 0.877 | GGE = CNG ccf x 0.877 |

| Diesel | Gallons | 1.155 | GGE = Diesel gal x 1.155 |

| E85 | Gallons | 0.734 | GGE = E85 gal x 0.734 |

| Electricity | kWh | 0.031 | GGE = Electricity kWh x 0.031 |

| Hydrogen | kg | 1.019 | GGE = H2 kg x 1.019 |

| LNG | Gallons @ 14.7 psi and -234°F | 0.666 | GGE = LNG gal x 0.666 |

| LPG | Gallons | 0.758 | GGE = LPG gal x 0.758 |

|

* See above for guidance on calculating B100 use. |

|||

FAQ Page Gives You Answers to Common Questions

Questions about reporting, complying with Program requirements, or administrative issues?

Make the Frequently Asked Questions for State and Alternative Fuel Provider Fleets your first stop. This page is updated often with new common questions. For instance, check out the new section added on Electric Drive Vehicles and Investment-Related Credits. If your question is not listed on the website, you may always contact the Program directly at regulatory.info@nrel.gov or 202-586-9171.

Fleets Use the EPAct Website to Communicate Credit Availability

Covered fleets may meet their Standard Compliance AFV-acquisition requirements by purchasing credits from other covered fleets. Fleets interested in buying credits should visit the Credits Bulletin Board and the Fleets with Excess Credits page. Fleets with banked credits they are interested in selling may post the availability of these banked credits on the Credits Bulletin Board, and ensure their contact information appears on the Fleets with Excess Credits page by selecting "Yes" under "Make credit balance public?" on the "Manage Fleet Contact" page in the Standard Compliance Reporting Tool.

Alternative Fuels Data Center Provides More Resources and Tools

DOE's Alternative Fuels Data Center (AFDC) provides a comprehensive set of tools for fleet managers looking to learn more about alternative fuels, advanced vehicle technologies, and fuel-saving measures. The AFDC website is regularly updated with new information, data, and resources to help fleets make informed decisions. Recent changes include:

- Publication of the Clean Cities 2014 Vehicle Buyer's Guide. This guidebook provides a comprehensive list of model year 2014 OEM light-duty AFVs by fuel and technology, including the manufacturer suggested retail price, fuel economy and emissions estimates, and engine size. The 2015 Buyer's Guide will be available later this fall.

- Updates to the Alternative Fueling Station Locator. This searchable tool provides nationwide station location information on biodiesel, E85, electric vehicle charging, hydrogen, natural gas, and propane, and is frequently updated with new features. For example, the Station Locator now provides data directly from EVSE networks on station locations, is available through an iPhone app, and includes new stations details, including vehicle size accessibility at natural gas stations and connector types at EVSE.

- Updates to the Federal and State Laws and Incentives tool. This searchable database provides information on federal and state laws and incentives for alternative fuels and vehicles, air quality, fuel efficiency, and other transportation-related topics. Recently added features include a keyword search and data download function.

- Release of the Argonne National Laboratory's Alternative Fuel Life-Cycle Environmental and Economic Transportation (AFLEET) Model. This spreadsheet-based tool can be used to calculate and compare vehicle emissions, petroleum use, and ownership costs of light- and heavy-duty AFVs, compared to conventional vehicles.

Common Fleet Questions Answered

Q. Under Standard Compliance, can my alternative fuel provider fleet get credit for acquiring a flexible fuel vehicle (FFV) when E85 is available, but I am not using the fuel in the vehicle?

A. No. Under DOE's EPAct fleet compliance program, covered alternative fuel providers must use alternative fuels in their AFVs except where and when the fuel is unavailable. For example, if E85 is available in your area, you must use the fuel in an FFV in order for the FFV to be counted as an AFV acquisition under DOE's EPAct fleet compliance program.

Q. Under Standard Compliance, is there a minimum blend level a fleet must use in mobile, non-road equipment in order to earn AFV credit for its investment in such equipment that operates on a blend of biodiesel?

A. Yes. To be eligible for AFV-credit based on investments in mobile, non-road equipment, the fleet must operate the equipment on alternative fuel. If the equipment is operated on biodiesel, it must be operated on B100 for the covered fleet's investment in such equipment to be eligible for AFV credit. If the equipment operates on a biodiesel blend, it does not qualify for AFV credit.

Q. Under Alternative Compliance, may a covered fleet include in its petroleum reduction plan and count towards it petroleum reduction requirement (PRR) the use of a biodiesel blend in the fleet's mobile, non-road equipment, and if so, is there a minimum blend level it must use?

A. Yes. Under Alternative Compliance, a covered fleet may include in its petroleum reduction plan and annual report (i.e., count toward its PRR) the neat biodiesel portion of any biodiesel blend used in the fleet's mobile, non-road equipment. As such, there is no minimum blend level the fleet must use in the equipment to be able to count the biodiesel portion of the blend. For example, a fleet using 10,000 gallons of B10 may count the 1,000 gallons of B100 that is contained in the 10,000 gallons of B10.

Q. Under Standard Compliance, in claiming credits for investments in alternative fuel infrastructure, alternative fuel non-road equipment, and/or relevant emerging technologies, may I include investments of money from grants or other monetary awards?

A. No. You may not include any funding that your fleet received through a grant or other monetary award. AFVs acquired using such funds, on the other hand, may be included as AFV acquisitions and earn credit toward compliance.